Subscribe To Our Newsletter

Subscribe To Our Newsletter

Subscribe to our newsletter and receive free educational articles and videos each month.

Subscribe to our newsletter and receive free educational articles and videos each month.

Main Menu

The Behavior Gap Part 3: Preventions – Three Behavioural Principles

“Successful Retirement” – a lifestyle-sustaining income and a legacy for those you love

Do you know your Successful Retirement Number?

“It won’t be the economy that will do in investors; it will be investors themselves.”

– Warren Buffett

The Behaviour Gap

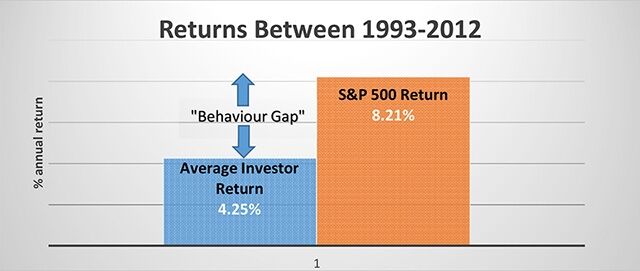

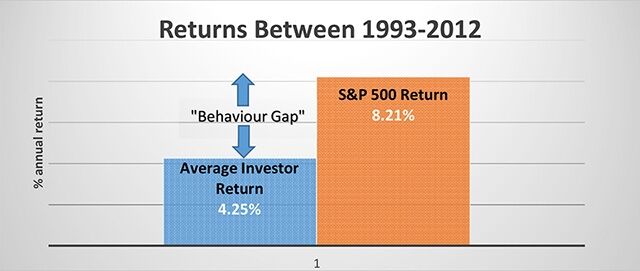

A Dalbar study using analytics and data from Lipper and the Investment Company Institute showed that investors do far more harm to themselves than they realize. It revealed that between 1992 and 2012, the S&P 500 returned 8.21% while the average investor received just 4.25%. This difference is known as the “Behaviour Gap”. What causes it? Simple – investors do the wrong things at the wrong time.

Preventing the Behaviour Gap

As human beings, we’re prone to making poor investment decisions because our emotions can often distort or ignore hard facts and rational thinking. After spending more than four decades in the investment advisory business, Nick Murray, the author of the book “Simple Wealth Inevitable Wealth”, identified Eight Great Mistakes commonly made which are detrimental to our investing health. So how do we prevent making these mistakes and avoid the Behaviour Gap?

Nick Murray suggests that there are 6 variables which he believes dictate 90% of an investor’s lifetime investment return. Three of these are attitudinal or behavioural principles and the other 3 are practices we should employ in the management of our investment portfolios:

| Three Behavioural PRINCIPLES 1. Faith in the Future 2. Patience 3. Discipline |

Three Portfolio PRACTICES 1. Asset Allocation 2. Diversification 3. Rebalancing |

Three Behavioural PRINCIPLES

1. Faith in the Future

Looking back and comparing where we were with where we are now would suggest the future has better things to come. Technology will advance, people will live longer, businesses will expand and the stock market will go higher. It has always been so. Therefore, when dealing with market corrections, we should treat it as just a temporary occurrence, a bump in the road to our long term investment goals because history tells us the market will recover and go even higher as time goes on. This kind of faith is critical for those of us who are planning for retirement and making investment plans that depend on how the market has behaved for the last 120 years. In fact, Nick Murray states that “…you will never make a good investor out of someone who is fundamentally afraid of the future.”

2. Patience

For many of us, our financial plan and portfolio will be designed to last a few decades. Given this fact, if our life goals haven’t changed, then we shouldn’t be changing our plans or the portfolio. Too many investors feel compelled to “do something” about their investments when they hear the latest news or investment fad or their neighbour’s returns. However, studies have proven that frequent trading is detrimental to your portfolio’s performance. Nick Murray advises “Never mind what’s working now; try to stay focused on what’s always worked in the long run.”

3. Discipline

The difference between patience and discipline is that discipline, according to Nick Murray, is the ability to keep doing the right thing even when it feels wrong. Patience has more to do with forbearance, or the capability not to do the wrong thing, like panicking out of the market at times of extreme pessimism. This may be difficult to do when everything you see and hear tells you that the world is coming to an end, but this is precisely when faith in the future comes into play. It reminds us that we have a long-term plan, and that given time, whatever crisis we’re experiencing will pass. At times like these, we should also rely on our investment advisor as our Behavioural Coach, to guide us in what we should and shouldn’t do.

Summary

Of the 6 variables identified by Nick Murray, if we embrace these 3 attitudinal / behavioural principles in our approach to investments, we would then have the proper mindset to employ the 3 practices that we should use in the management of our investments. Nick Murray states that “the principles dictate the practices, in the sense that beliefs always dictate behaviours.” We will discuss the 3 practices in Part 4 of this Behaviour Gap series.

Capital Concepts Group at iA Private Wealth is committed to helping you achieve your

Successful Retirement. Call us.

Suite 1030 – 4720 Kingsway, Metrotower 2, Burnaby, BC V5H-4N2, (604) 432-7743, [email protected]

Each remaining part of this series will be published on a monthly basis. Please check back.

TThis article was prepared solely by Chad Ekren who is a registered representative of iA Private Wealth, a member of the Canadian Investor Protection Fund (CIPF) and the Investment Industry Regulatory Organization of Canada (IIROC). The views and opinions, including any recommendations, expressed in this article are those of Chad Ekren alone and not those of iA Private Wealth. Capital Concepts and Capital Concepts Group are personal trade names of Chad Ekren. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.

The Behavior Gap Part 3: Preventions – Three Behavioural Principles

“Successful Retirement” – a lifestyle-sustaining income and a legacy for those you love

Do you know your Successful Retirement Number?

“It won’t be the economy that will do in investors; it will be investors themselves.”

– Warren Buffett

The Behaviour Gap

A Dalbar study using analytics and data from Lipper and the Investment Company Institute showed that investors do far more harm to themselves than they realize. It revealed that between 1992 and 2012, the S&P 500 returned 8.21% while the average investor received just 4.25%. This difference is known as the “Behaviour Gap”. What causes it? Simple – investors do the wrong things at the wrong time.

Preventing the Behaviour Gap

As human beings, we’re prone to making poor investment decisions because our emotions can often distort or ignore hard facts and rational thinking. After spending more than four decades in the investment advisory business, Nick Murray, the author of the book “Simple Wealth Inevitable Wealth”, identified Eight Great Mistakes commonly made which are detrimental to our investing health. So how do we prevent making these mistakes and avoid the Behaviour Gap?

Nick Murray suggests that there are 6 variables which he believes dictate 90% of an investor’s lifetime investment return. Three of these are attitudinal or behavioural principles and the other 3 are practices we should employ in the management of our investment portfolios:

| Three Behavioural PRINCIPLES 1. Faith in the Future 2. Patience 3. Discipline |

Three Portfolio PRACTICES 1. Asset Allocation 2. Diversification 3. Rebalancing |

Three Behavioural PRINCIPLES

1. Faith in the Future

Looking back and comparing where we were with where we are now would suggest the future has better things to come. Technology will advance, people will live longer, businesses will expand and the stock market will go higher. It has always been so. Therefore, when dealing with market corrections, we should treat it as just a temporary occurrence, a bump in the road to our long term investment goals because history tells us the market will recover and go even higher as time goes on. This kind of faith is critical for those of us who are planning for retirement and making investment plans that depend on how the market has behaved for the last 120 years. In fact, Nick Murray states that “…you will never make a good investor out of someone who is fundamentally afraid of the future.”

2. Patience

For many of us, our financial plan and portfolio will be designed to last a few decades. Given this fact, if our life goals haven’t changed, then we shouldn’t be changing our plans or the portfolio. Too many investors feel compelled to “do something” about their investments when they hear the latest news or investment fad or their neighbour’s returns. However, studies have proven that frequent trading is detrimental to your portfolio’s performance. Nick Murray advises “Never mind what’s working now; try to stay focused on what’s always worked in the long run.”

3. Discipline

The difference between patience and discipline is that discipline, according to Nick Murray, is the ability to keep doing the right thing even when it feels wrong. Patience has more to do with forbearance, or the capability not to do the wrong thing, like panicking out of the market at times of extreme pessimism. This may be difficult to do when everything you see and hear tells you that the world is coming to an end, but this is precisely when faith in the future comes into play. It reminds us that we have a long-term plan, and that given time, whatever crisis we’re experiencing will pass. At times like these, we should also rely on our investment advisor as our Behavioural Coach, to guide us in what we should and shouldn’t do.

Summary

Of the 6 variables identified by Nick Murray, if we embrace these 3 attitudinal / behavioural principles in our approach to investments, we would then have the proper mindset to employ the 3 practices that we should use in the management of our investments. Nick Murray states that “the principles dictate the practices, in the sense that beliefs always dictate behaviours.” We will discuss the 3 practices in Part 4 of this Behaviour Gap series.

Capital Concepts Group at iA Private Wealth is committed to helping you achieve your

Successful Retirement. Call us.

Suite 1030 – 4720 Kingsway, Metrotower 2, Burnaby, BC V5H-4N2, (604) 432-7743, [email protected]

Each remaining part of this series will be published on a monthly basis. Please check back.

TThis article was prepared solely by Chad Ekren who is a registered representative of iA Private Wealth, a member of the Canadian Investor Protection Fund (CIPF) and the Investment Industry Regulatory Organization of Canada (IIROC). The views and opinions, including any recommendations, expressed in this article are those of Chad Ekren alone and not those of iA Private Wealth. Capital Concepts and Capital Concepts Group are personal trade names of Chad Ekren. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.