Subscribe To Our Newsletter

Subscribe To Our Newsletter

Subscribe to our newsletter and receive free educational articles and videos each month.

Subscribe to our newsletter and receive free educational articles and videos each month.

Main Menu

The Behavior Gap Part 4: Preventions – Three Portfolio Practices

“Successful Retirement” – a lifestyle-sustaining income and a legacy for those you love

Do you know your Successful Retirement Number?

“It won’t be the economy that will do in investors; it will be investors themselves.”

– Warren Buffett

The Behaviour Gap

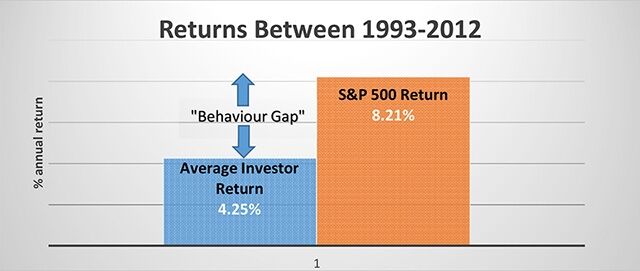

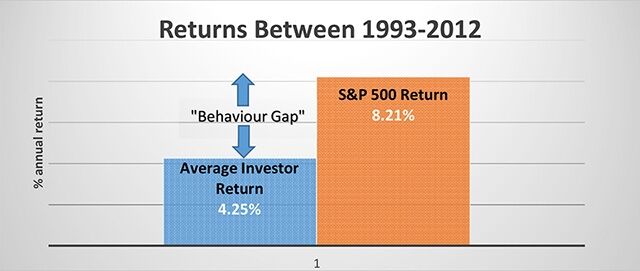

A Dalbar study using analytics and data from Lipper and the Investment Company Institute showed that investors do far more harm to themselves than they realize. It revealed that between 1992 and 2012, the S&P 500 returned 8.21% while the average investor received just 4.25%. This difference is known as the “Behaviour Gap”. What causes it? Simple – investors do the wrong things at the wrong time.

Preventing the Behaviour Gap

As human beings, we’re prone to making poor investment decisions because our emotions can often distort or ignore hard facts and rational thinking. After spending more than four decades in the investment advisory business, Nick Murray, the author of the book “Simple Wealth Inevitable Wealth”, identified Eight Great Mistakes commonly made which are detrimental to our investing health. So how do we prevent making these mistakes and avoid the Behaviour Gap?

Nick Murray suggests that there are 6 variables which he believes dictate 90% of an investor’s lifetime investment return. Three of these are attitudinal or behavioural principles and the other 3 are practices we should employ in the management of our investment portfolios:

| Three Behavioural PRINCIPLES 1. Faith in the Future 2. Patience 3. Discipline |

Three Portfolio PRACTICES 1. Asset Allocation 2. Diversification 3. Rebalancing |

Three Portfolio PRINCIPLES

1. Asset Allocation

Investment professionals agree that asset allocation is a critical determinant to portfolio performance. A Vanguard research paper showed that 82% of a portfolio’s return can be attributed to asset allocation, while only 18% is attributed to security selection and market timing.¹ How you spread your portfolio amongst the main asset classes of Equities (stocks), Fixed Income (bonds & equivalents), and Cash will largely determine the returns you receive over the long run. However, since returns are directly correlated to volatility, a higher return would mean a higher volatility in your portfolio and vice versa. Having greater portions of your portfolio in Equities may provide a higher return over the long run, but the ups and downs of the portfolio will also be higher. Fixed Income investments have lower ups and downs, but their after tax returns may not keep up with the rate of inflation. So a balance must be made between performance and volatility or risk when asset allocation decisions are made. The “proper” allocation for an individual will depend on a balance between the required return of the portfolio and the risk tolerance of the individual, as well as the time horizon for their financial goals.

1. Vanguard research paper “The Global Case for Strategic Asset Allocation” (Wallick et al., 2012)

2. Diversification

The second practice we need to employ is mixing the investments we hold in our asset classes with various types, industries, sectors, countries, and so on, in order to achieve a diverse holding. Because the prices of various investments do not move in the same way (i.e. uncorrelated), having a diverse number of holdings will tend to reduce the price volatility of the portfolio. However, we do need to guard against over-diversification, as this would tend to dampen the overall portfolio performance.

3. Rebalancing

If setting proper asset allocation is key to matching our long term financial goals and risk tolerance, then it stands to reason that when the asset allocation is out of alignment, we should adjust it back to the original proportions. This practice is known as “rebalancing” a portfolio. Should an asset class become out of proportion due to gains or losses, we need to bring it back in line by selling or buying this asset class until the portfolio’s asset allocation is equal to the prescribed proportions again. Your investment advisor should be monitoring this for you and should advise you when rebalancing ought to occur.

Summary

These 3 practices, along with the 3 attitudinal/behavioural principles discussed previously, comprise the 6 variables that Nick Murray states will determine 90% of our investment outcome in the long term. If we can follow these 6 variables, history tells us that we have a very high probability of achieving our long term investment goals. This is exactly what we at Capital Concepts Group are dedicated to doing.

Capital Concepts Group at iA Private Wealth is committed to helping you achieve your

Successful Retirement. Call us.

Suite 1030 – 4720 Kingsway, Metrotower 2, Burnaby, BC V5H-4N2, (604) 432-7743, [email protected]

Each remaining part of this series will be published on a monthly basis. Please check back.

TThis article was prepared solely by Chad Ekren who is a registered representative of iA Private Wealth, a member of the Canadian Investor Protection Fund (CIPF) and the Investment Industry Regulatory Organization of Canada (IIROC). The views and opinions, including any recommendations, expressed in this article are those of Chad Ekren alone and not those of iA Private Wealth. Capital Concepts and Capital Concepts Group are personal trade names of Chad Ekren. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.

The Behavior Gap Part 4: Preventions – Three Portfolio Practices

“Successful Retirement” – a lifestyle-sustaining income and a legacy for those you love

Do you know your Successful Retirement Number?

“It won’t be the economy that will do in investors; it will be investors themselves.”

– Warren Buffett

The Behaviour Gap

A Dalbar study using analytics and data from Lipper and the Investment Company Institute showed that investors do far more harm to themselves than they realize. It revealed that between 1992 and 2012, the S&P 500 returned 8.21% while the average investor received just 4.25%. This difference is known as the “Behaviour Gap”. What causes it? Simple – investors do the wrong things at the wrong time.

Preventing the Behaviour Gap

As human beings, we’re prone to making poor investment decisions because our emotions can often distort or ignore hard facts and rational thinking. After spending more than four decades in the investment advisory business, Nick Murray, the author of the book “Simple Wealth Inevitable Wealth”, identified Eight Great Mistakes commonly made which are detrimental to our investing health. So how do we prevent making these mistakes and avoid the Behaviour Gap?

Nick Murray suggests that there are 6 variables which he believes dictate 90% of an investor’s lifetime investment return. Three of these are attitudinal or behavioural principles and the other 3 are practices we should employ in the management of our investment portfolios:

| Three Behavioural PRINCIPLES 1. Faith in the Future 2. Patience 3. Discipline |

Three Portfolio PRACTICES 1. Asset Allocation 2. Diversification 3. Rebalancing |

Three Portfolio PRINCIPLES

1. Asset Allocation

Investment professionals agree that asset allocation is a critical determinant to portfolio performance. A Vanguard research paper showed that 82% of a portfolio’s return can be attributed to asset allocation, while only 18% is attributed to security selection and market timing.¹ How you spread your portfolio amongst the main asset classes of Equities (stocks), Fixed Income (bonds & equivalents), and Cash will largely determine the returns you receive over the long run. However, since returns are directly correlated to volatility, a higher return would mean a higher volatility in your portfolio and vice versa. Having greater portions of your portfolio in Equities may provide a higher return over the long run, but the ups and downs of the portfolio will also be higher. Fixed Income investments have lower ups and downs, but their after tax returns may not keep up with the rate of inflation. So a balance must be made between performance and volatility or risk when asset allocation decisions are made. The “proper” allocation for an individual will depend on a balance between the required return of the portfolio and the risk tolerance of the individual, as well as the time horizon for their financial goals.

1. Vanguard research paper “The Global Case for Strategic Asset Allocation” (Wallick et al., 2012)

2. Diversification

The second practice we need to employ is mixing the investments we hold in our asset classes with various types, industries, sectors, countries, and so on, in order to achieve a diverse holding. Because the prices of various investments do not move in the same way (i.e. uncorrelated), having a diverse number of holdings will tend to reduce the price volatility of the portfolio. However, we do need to guard against over-diversification, as this would tend to dampen the overall portfolio performance.

3. Rebalancing

If setting proper asset allocation is key to matching our long term financial goals and risk tolerance, then it stands to reason that when the asset allocation is out of alignment, we should adjust it back to the original proportions. This practice is known as “rebalancing” a portfolio. Should an asset class become out of proportion due to gains or losses, we need to bring it back in line by selling or buying this asset class until the portfolio’s asset allocation is equal to the prescribed proportions again. Your investment advisor should be monitoring this for you and should advise you when rebalancing ought to occur.

Summary

These 3 practices, along with the 3 attitudinal/behavioural principles discussed previously, comprise the 6 variables that Nick Murray states will determine 90% of our investment outcome in the long term. If we can follow these 6 variables, history tells us that we have a very high probability of achieving our long term investment goals. This is exactly what we at Capital Concepts Group are dedicated to doing.

Capital Concepts Group at iA Private Wealth is committed to helping you achieve your

Successful Retirement. Call us.

Suite 1030 – 4720 Kingsway, Metrotower 2, Burnaby, BC V5H-4N2, (604) 432-7743, [email protected]

Each remaining part of this series will be published on a monthly basis. Please check back.

TThis article was prepared solely by Chad Ekren who is a registered representative of iA Private Wealth, a member of the Canadian Investor Protection Fund (CIPF) and the Investment Industry Regulatory Organization of Canada (IIROC). The views and opinions, including any recommendations, expressed in this article are those of Chad Ekren alone and not those of iA Private Wealth. Capital Concepts and Capital Concepts Group are personal trade names of Chad Ekren. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.