Subscribe To Our Newsletter

Subscribe To Our Newsletter

Subscribe to our newsletter and receive free educational articles and videos each month.

Subscribe to our newsletter and receive free educational articles and videos each month.

Main Menu

The Behavior Gap Part 2: #5-8 Of The Eight Great Mistakes

“Successful Retirement” – a lifestyle-sustaining income and a legacy for those you love

Do you know your Successful Retirement Number?

“The investor’s chief problem – and even his worst enemy – is likely to be himself.”

– Benjamin Graham

The Behaviour Gap

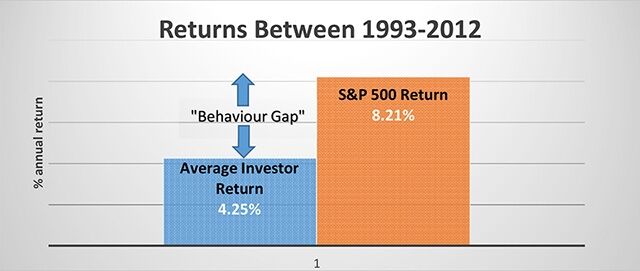

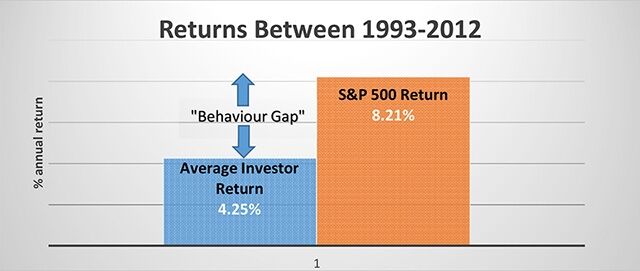

A Dalbar study using analytics and data from Lipper and the Investment Company Institute showed that investors do far more harm to themselves than they realize. It revealed that between 1992 and 2012, the S&P 500 returned 8.21% while the average investor received just 4.25%. This difference is known as the “Behaviour Gap”. What causes it? Simple – investors do the wrong things at the wrong time.

Eight Great Mistakes

As human beings, our emotions can often distort or ignore hard facts and rational thinking. We fall prone to making decisions that we might not otherwise make when we have a clear, unemotional mindset. Nick Murray, the author of the book “Simple Wealth Inevitable Wealth”, identified Eight Great Mistakes which are commonly made that are detrimental to one’s investing health. They are:

| 1. Under-Diversification | 5. Speculating When You Think You’re Investing |

| 2. Over-Diversification | 6. Investing For Yield Instead of For Total Return |

| 3. Euphoria/ Overconfidence |

7. Letting Your Cost Basis Dictate Investment Decisions |

| 4. Panic | 8. Leverage |

Number 1 – 4 of the Eight Great Mistakes were discussed in Part 1 of this series. We will now discuss numbers 5 – 8:

5. Speculating When You Think You Are Investing

Speculation is not based on investing fundamentals. It does not rely on company research, financial analysis or planning. It is simply betting on the continuation of a price trend, whether the vehicle is a stock, bond, commodity, or real estate or anything else. Often, it is the greed within us that pushes us into speculation. When we see that the price of an investment has gone up and up, there is a tendency for us to “get in on the action”. However, speculation, like any other forms of gambling, provides no assurance of a positive outcome, and therefore has no place in a well thought out financial plan.

6. Investing For Yield Instead of For Total Return

Rising dividend yields is one of the reasons stocks provide protection against inflation. But it is not the only reason. The price of the stock will need to increase as well if we’re looking to maintain our purchasing power over the long term. What we need to maximize is the total return of our portfolios, which includes both yield and price increases of a stock. Therefore, if we make investment decisions purely on the yield aspect of a stock without regard for its future growth or financial well-being, we could make the mistake of buying the wrong stocks for our retirement portfolio.

7. Letting Your Cost Basis Dictate Investment Decisions

Refusing to reduce a significant exposure to one particular investment because you don’t want to pay capital gains tax is unwise. This can lead to under-diversification of your investment portfolio and you could end up paying a bigger price than the capital gains tax if your over-concentrated investment suddenly has something go wrong. Alternatively, holding onto “losers” in your portfolio because “I can’t take the loss” or “I have to wait to get even” is also unwise if the fundamentals of the investment in question no longer fits the criteria you have for holding it. Our objective should be to migrate towards a high-quality, broadly diversified portfolio of rising income investments where our cost base won’t deter us from making wise decisions.

8. Leverage

Leverage is using borrowed money to make an investment. Sometimes it can make sense, such as buying real estate in a buoyant market, or arbitraging the interest difference between the loan and the yield from a blue chip stock. Leverage lets us control and reap the gains from a larger investment holding than we are able to have without borrowing. However, it also works in reverse if the investment does not behave as we planned, as leverage will magnify our losses. And since we’re susceptible to making some of the other 8 great mistakes while using leverage, we can put ourselves into deep trouble very quickly when using leverage. Therefore, it’s best to avoid something that can magnify our mistakes.

Summary

Because we are emotional creatures, we are hard-wired for making mistakes in investing. Very few people are capable of controlling their emotions to the point of consistently making good investment decisions and avoiding the 8 great mistakes. Most of us need help from a professional Behavioural Coach, an investment advisor who understands and can guide us to making the right decisions.

Capital Concepts Group at iA Private Wealth is committed to helping you achieve your

Successful Retirement. Call us.

Suite 1030 – 4720 Kingsway, Metrotower 2, Burnaby, BC V5H-4N2, (604) 432-7743, [email protected]

Each remaining part of this series will be published on a monthly basis. Please check back.

TThis article was prepared solely by Chad Ekren who is a registered representative of iA Private Wealth, a member of the Canadian Investor Protection Fund (CIPF) and the Investment Industry Regulatory Organization of Canada (IIROC). The views and opinions, including any recommendations, expressed in this article are those of Chad Ekren alone and not those of iA Private Wealth. Capital Concepts and Capital Concepts Group are personal trade names of Chad Ekren. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.

The Behavior Gap Part 2: #5-8 Of The Eight Great Mistakes

“Successful Retirement” – a lifestyle-sustaining income and a legacy for those you love

Do you know your Successful Retirement Number?

“The investor’s chief problem – and even his worst enemy – is likely to be himself.”

– Benjamin Graham

The Behaviour Gap

A Dalbar study using analytics and data from Lipper and the Investment Company Institute showed that investors do far more harm to themselves than they realize. It revealed that between 1992 and 2012, the S&P 500 returned 8.21% while the average investor received just 4.25%. This difference is known as the “Behaviour Gap”. What causes it? Simple – investors do the wrong things at the wrong time.

Eight Great Mistakes

As human beings, our emotions can often distort or ignore hard facts and rational thinking. We fall prone to making decisions that we might not otherwise make when we have a clear, unemotional mindset. Nick Murray, the author of the book “Simple Wealth Inevitable Wealth”, identified Eight Great Mistakes which are commonly made that are detrimental to one’s investing health. They are:

| 1. Under-Diversification 2. Over-Diversification 3. Euphoria/Overconfidence 4. Panic |

5. Speculating When You Think You’re Investing 6. Investing For Yield Instead of For Total Return 7. Letting Your Cost Basis Dictate Investment Decisions 8. Leverage |

Number 1 – 4 of the Eight Great Mistakes were discussed in Part 1 of this series. We will now discuss numbers 5 – 8:

5. Speculating When You Think You Are Investing

Speculation is not based on investing fundamentals. It does not rely on company research, financial analysis or planning. It is simply betting on the continuation of a price trend, whether the vehicle is a stock, bond, commodity, or real estate or anything else. Often, it is the greed within us that pushes us into speculation. When we see that the price of an investment has gone up and up, there is a tendency for us to “get in on the action”. However, speculation, like any other forms of gambling, provides no assurance of a positive outcome, and therefore has no place in a well thought out financial plan.

6. Investing For Yield Instead of For Total Return

Rising dividend yields is one of the reasons stocks provide protection against inflation. But it is not the only reason. The price of the stock will need to increase as well if we’re looking to maintain our purchasing power over the long term. What we need to maximize is the total return of our portfolios, which includes both yield and price increases of a stock. Therefore, if we make investment decisions purely on the yield aspect of a stock without regard for its future growth or financial well-being, we could make the mistake of buying the wrong stocks for our retirement portfolio.

7. Letting Your Cost Basis Dictate Investment Decisions

Refusing to reduce a significant exposure to one particular investment because you don’t want to pay capital gains tax is unwise. This can lead to under-diversification of your investment portfolio and you could end up paying a bigger price than the capital gains tax if your over-concentrated investment suddenly has something go wrong. Alternatively, holding onto “losers” in your portfolio because “I can’t take the loss” or “I have to wait to get even” is also unwise if the fundamentals of the investment in question no longer fits the criteria you have for holding it. Our objective should be to migrate towards a high-quality, broadly diversified portfolio of rising income investments where our cost base won’t deter us from making wise decisions.

8. Leverage

Leverage is using borrowed money to make an investment. Sometimes it can make sense, such as buying real estate in a buoyant market, or arbitraging the interest difference between the loan and the yield from a blue chip stock. Leverage lets us control and reap the gains from a larger investment holding than we are able to have without borrowing. However, it also works in reverse if the investment does not behave as we planned, as leverage will magnify our losses. And since we’re susceptible to making some of the other 8 great mistakes while using leverage, we can put ourselves into deep trouble very quickly when using leverage. Therefore, it’s best to avoid something that can magnify our mistakes.

Summary

Because we are emotional creatures, we are hard-wired for making mistakes in investing. Very few people are capable of controlling their emotions to the point of consistently making good investment decisions and avoiding the 8 great mistakes. Most of us need help from a professional Behavioural Coach, an investment advisor who understands and can guide us to making the right decisions.

Capital Concepts Group at iA Private Wealth is committed to helping you achieve your

Successful Retirement. Call us.

Suite 1030 – 4720 Kingsway, Metrotower 2, Burnaby, BC V5H-4N2, (604) 432-7743, [email protected]

Each remaining part of this series will be published on a monthly basis. Please check back.

TThis article was prepared solely by Chad Ekren who is a registered representative of iA Private Wealth, a member of the Canadian Investor Protection Fund (CIPF) and the Investment Industry Regulatory Organization of Canada (IIROC). The views and opinions, including any recommendations, expressed in this article are those of Chad Ekren alone and not those of iA Private Wealth. Capital Concepts and Capital Concepts Group are personal trade names of Chad Ekren. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.