Subscribe To Our Newsletter

Subscribe To Our Newsletter

Subscribe to our newsletter and receive free educational articles and videos each month.

Subscribe to our newsletter and receive free educational articles and videos each month.

Main Menu

“Successful Retirement” – a lifestyle-sustaining income and a legacy for those you love

Do you know your Successful Retirement Number?

“The investor’s chief problem – and even his worst enemy – is likely to be himself.”

– Benjamin Graham

The Behaviour Gap

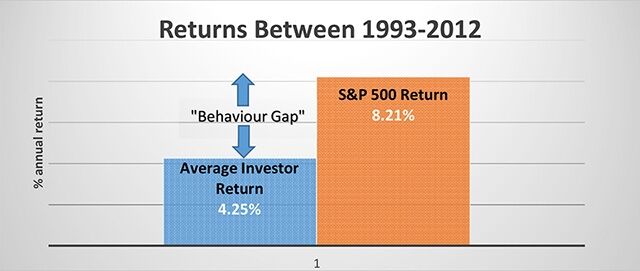

A Dalbar study using analytics and data from Lipper and the Investment Company Institute showed that investors do far more harm to themselves than they realize. It revealed that between 1992 and 2012, the S&P 500 returned 8.21% while the average investor received just 4.25%. This difference is known as the “Behaviour Gap”. What causes it? Simple – investors do the wrong things at the wrong time.

Eight Great Mistakes

As human beings, our emotions can often distort or ignore hard facts and rational thinking. We fall prone to making decisions that we might not otherwise make when we have a clear, unemotional mindset. Nick Murray, the author of the book “Simple Wealth Inevitable Wealth”, identified Eight Great Mistakes which are commonly made that are detrimental to one’s investing health. They are:

| 1. Under-Diversification | 5. Speculating When You Think You’re Investing |

| 2. Over-Diversification | 6. Investing For Yield Instead of For Total Return |

| 3. Euphoria/ Overconfidence |

7. Letting Your Cost Basis Dictate Investment Decisions |

| 4. Panic | 8. Leverage |

The worst mistake of these eight is the one you are about to make. Therefore, these eight mistakes are being shared with you in no particular order of importance:

1. Under-Diversification

Investing professionals tell us that we need to be invested in different asset classes, categories, stocks, industries, countries and so on, in order to reduce portfolio volatility or risk. Individual stocks will have both company specific (unsystematic) risk as well as market (systematic) risk. That is why the price volatility of a single stock is generally greater than the price volatility of the market index, such as the S&P500 or TSX300. To reduce or eliminate the company specific risk of a single stock, you must hold other stocks whose price movement is different, or uncorrelated to that single stock. Studies show that when you hold a basket of 15-20 uncorrelated stocks from different industries, sectors, or countries, company specific (unsystematic) risk can be virtually eliminated. This means your portfolio will be less volatile overall. To lower volatility and risk even further, your portfolio should include other asset classes, such as treasury bills, bonds, commodities, and other types of investments.

2. Over-Diversification

On the other hand, too much diversification can also be detrimental. Owning too much of everything can amount to owning nothing because it takes away the potential impact of big gainers on your portfolio’s performance. As discussed above, diversifying your investments is needed to reduce volatility or risk, but over-diversification can subdue the overall performance of your portfolio, and make it harder to manage. The key is to strike a balance between diversifying enough to reduce risk and yet avoiding over-diversification which stifles performance.

3. Euphoria/Overconfidence

Overconfidence comes when our portfolios have done well. The greater the gains are, the greater the overconfidence becomes, which then leads to euphoria. This could be a dangerous time, because then we tend to ignore the risks to our principal when making investment decisions. We start to believe that we “can’t miss”, and then commit some of the 8 great mistakes, such as under or over-diversifying, speculating and leveraging. Whenever we feel we’re invincible, it is a good time to sit back and assess where we are in relation to our financial plan and whether or not anything needs to be done. It may be a good time to call your investment advisor, who being your behavioural coach, is likely the best one to give you some advice.

4. Panic

At the other end of the spectrum, when our portfolios are doing poorly, it may create dismay and fear. The greater the losses become, the greater the level of fear, which can eventually lead to panic. Then we act irrationally, often resulting in selling investments at the wrong time. We forget that markets inevitably go through cycles of ups and downs. If we don’t sell and leave our portfolios alone, it will likely go back up again, often higher than ever before. At these times, your investment advisor’s role as Behavioural Coach is perhaps of the greatest value to your portfolio. So if you feel the throes of panic setting in, pick up the phone and talk to your advisor.

Capital Concepts Group at iA Private Wealth is committed to helping you achieve your

Successful Retirement. Call us.

Suite 1030 – 4720 Kingsway, Metrotower 2, Burnaby, BC V5H-4N2, (604) 432-7743, [email protected]

Each remaining part of this series will be published on a monthly basis. Please check back.

TThis article was prepared solely by Chad Ekren who is a registered representative of iA Private Wealth, a member of the Canadian Investor Protection Fund (CIPF) and the Investment Industry Regulatory Organization of Canada (IIROC). The views and opinions, including any recommendations, expressed in this article are those of Chad Ekren alone and not those of iA Private Wealth. Capital Concepts and Capital Concepts Group are personal trade names of Chad Ekren. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.

The Behavior Gap Part 1: #1-4 Of The Eight Great Mistakes

“Successful Retirement” – a lifestyle-sustaining income and a legacy for those you love

Do you know your Successful Retirement Number?

“The investor’s chief problem – and even his worst enemy – is likely to be himself.”

– Benjamin Graham

The Behaviour Gap

A Dalbar study using analytics and data from Lipper and the Investment Company Institute showed that investors do far more harm to themselves than they realize. It revealed that between 1992 and 2012, the S&P 500 returned 8.21% while the average investor received just 4.25%. This difference is known as the “Behaviour Gap”. What causes it? Simple – investors do the wrong things at the wrong time.

Eight Great Mistakes

As human beings, our emotions can often distort or ignore hard facts and rational thinking. We fall prone to making decisions that we might not otherwise make when we have a clear, unemotional mindset. Nick Murray, the author of the book “Simple Wealth Inevitable Wealth”, identified Eight Great Mistakes which are commonly made that are detrimental to one’s investing health. They are:

| 1. Under-Diversification 2. Over-Diversification 3. Euphoria/Overconfidence 4. Panic |

5. Speculating When You Think You’re Investing 6. Investing For Yield Instead of For Total Return 7. Letting Your Cost Basis Dictate Investment Decisions 8. Leverage |

The worst mistake of these eight is the one you are about to make. Therefore, these eight mistakes are being shared with you in no particular order of importance:

1. Under-Diversification

Investing professionals tell us that we need to be invested in different asset classes, categories, stocks, industries, countries and so on, in order to reduce portfolio volatility or risk. Individual stocks will have both company specific (unsystematic) risk as well as market (systematic) risk. That is why the price volatility of a single stock is generally greater than the price volatility of the market index, such as the S&P500 or TSX300. To reduce or eliminate the company specific risk of a single stock, you must hold other stocks whose price movement is different, or uncorrelated to that single stock. Studies show that when you hold a basket of 15-20 uncorrelated stocks from different industries, sectors, or countries, company specific (unsystematic) risk can be virtually eliminated. This means your portfolio will be less volatile overall. To lower volatility and risk even further, your portfolio should include other asset classes, such as treasury bills, bonds, commodities, and other types of investments.

2. Over-Diversification

On the other hand, too much diversification can also be detrimental. Owning too much of everything can amount to owning nothing because it takes away the potential impact of big gainers on your portfolio’s performance. As discussed above, diversifying your investments is needed to reduce volatility or risk, but over-diversification can subdue the overall performance of your portfolio, and make it harder to manage. The key is to strike a balance between diversifying enough to reduce risk and yet avoiding over-diversification which stifles performance.

3. Euphoria/Overconfidence

Overconfidence comes when our portfolios have done well. The greater the gains are, the greater the overconfidence becomes, which then leads to euphoria. This could be a dangerous time, because then we tend to ignore the risks to our principal when making investment decisions. We start to believe that we “can’t miss”, and then commit some of the 8 great mistakes, such as under or over-diversifying, speculating and leveraging. Whenever we feel we’re invincible, it is a good time to sit back and assess where we are in relation to our financial plan and whether or not anything needs to be done. It may be a good time to call your investment advisor, who being your behavioural coach, is likely the best one to give you some advice.

4. Panic

At the other end of the spectrum, when our portfolios are doing poorly, it may create dismay and fear. The greater the losses become, the greater the level of fear, which can eventually lead to panic. Then we act irrationally, often resulting in selling investments at the wrong time. We forget that markets inevitably go through cycles of ups and downs. If we don’t sell and leave our portfolios alone, it will likely go back up again, often higher than ever before. At these times, your investment advisor’s role as Behavioural Coach is perhaps of the greatest value to your portfolio. So if you feel the throes of panic setting in, pick up the phone and talk to your advisor.

Capital Concepts Group at iA Private Wealth is committed to helping you achieve your

Successful Retirement. Call us.

Suite 1030 – 4720 Kingsway, Metrotower 2, Burnaby, BC V5H-4N2, (604) 432-7743, [email protected]

Each remaining part of this series will be published on a monthly basis. Please check back.

TThis article was prepared solely by Chad Ekren who is a registered representative of iA Private Wealth, a member of the Canadian Investor Protection Fund (CIPF) and the Investment Industry Regulatory Organization of Canada (IIROC). The views and opinions, including any recommendations, expressed in this article are those of Chad Ekren alone and not those of iA Private Wealth. Capital Concepts and Capital Concepts Group are personal trade names of Chad Ekren. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.